Featured

17 Oct 2025

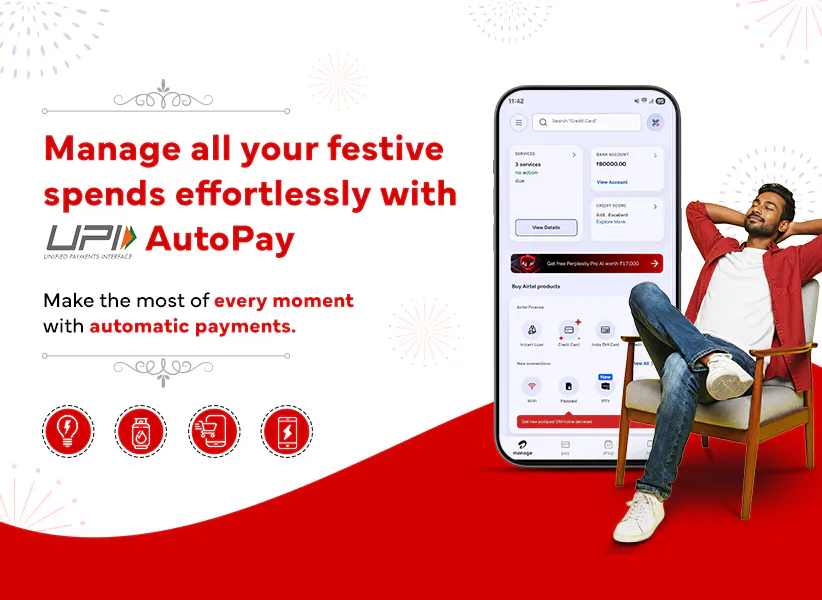

UPI AutoPay: The Festive Season’s Secret to Effortless Payments and Smart Spending

The festive season is that time of the year when your social calendar is brimming with invites, your shopping lists and sprees are endless, and your mind is constantly occupied with party planning. With all this going on, it’s easy to miss payment deadlines on due bills, EMIs on loans, and your favourite subscriptions.

01 Sep 2025

Go Cashless, Go Smart: Secure Your Payments with a Safe Second Account

Do you still fumble for loose change when paying for your daily chai (or matcha, if you’re one of those)? Or, juggle between multiple bank accounts every time you make a payment? You know, there’s one for salary, one for savings, and one for splurging…

09 Nov 2025

Why Having a Second Bank Account Is a Smart Financial Move

Managing money in the digital age is convenient, but it also means your primary savings account ends up doing more than just holding funds: it’s used for everything from recharges to bills to shopping. Now imagine if you could keep your “core savings” safe and use a separate space for everyday spending? That’s where a second bank account comes in.

18 Oct 2025

How to Grow Your Money Safely with Fixed Deposits This Festive Season

We often associate festivals with big spending, but it’s also the time when you save money. Whether it’s the Diwali bonus from your company or the shaguns from relatives, this cash inflow becomes part of your festive savings. Instead of splurging it, why not invest it and multiply it? And when it comes to investment, nothing beats the reliability of fixed deposits (FD).

08 Sep 2025

Is Your Bank Account Secure? Tips to Stay Safe with a Safe Second Account

Have you ever wondered how many transactions you make in a day? From your regular commute to your daily coffee, most of these payments are made online. And every time you make an online payment with your savings or salary account, you’re exposing your funds to potential threats. Whether it’s a phishing scam or a data breach, the risks of digital fraud are growing by the day.

08 Sep 2025

A Complete Guide to Fixed Deposits -Features, Benefits, and Eligibility Criteria

Tired of monitoring the market every day and still missing out on luck? It’s time to turn to the good old fixed deposit and take out the guesswork from money-making. Whether you're setting funds aside for a big purchase or just want a safe, straightforward way to build your wealth, a fixed deposit is a time-tested option.

22 Mar 2025

Declutter Your Finances & Open a Safe Second Account For Daily Transactions

Managing your finances efficiently is more crucial than ever, isn’t it? As we juggle multiple financial responsibilities—our utility bills, savings, investments, and daily expenses—it's easy to feel overwhelmed. The most efficient strategy to streamline your daily expenses is to declutter your finances have a better track on your savings.

28 Feb 2025

Great Place To Work

We are thrilled to be recognized as a Great Place to Work yet again! This recognition is a testament to our unwavering commitment to fostering a culture where innovation, collaboration, and growth thrive.

13 Jan 2025

Airtel Payments Bank collaborates with Noise and NPCI to unveil its upcoming NCMC-Enabled Smartwatch

Airtel Payments Bank in collaboration with Noise, India's leading smartwatch and connected lifestyle brand, and the National Payments Corporation of India (NPCI), announced the launch of its upcoming cutting-edge NCMC (National Common Mobility Card)-enabled Smartwatch, integrated with the RuPay chip.

Featured

17 Oct 2025

UPI AutoPay: The Festive Season’s Secret to Effortless Payments and Smart Spending

The festive season is that time of the year when your social calendar is brimming with invites, your shopping lists and sprees are endless, and your mind is constantly occupied with party planning. With all this going on, it’s easy to miss payment deadlines on due bills, EMIs on loans, and your favourite subscriptions.

01 Sep 2025

Go Cashless, Go Smart: Secure Your Payments with a Safe Second Account

Do you still fumble for loose change when paying for your daily chai (or matcha, if you’re one of those)? Or, juggle between multiple bank accounts every time you make a payment? You know, there’s one for salary, one for savings, and one for splurging…

09 Nov 2025

Why Having a Second Bank Account Is a Smart Financial Move

Managing money in the digital age is convenient, but it also means your primary savings account ends up doing more than just holding funds: it’s used for everything from recharges to bills to shopping. Now imagine if you could keep your “core savings” safe and use a separate space for everyday spending? That’s where a second bank account comes in.

Blogs

14 Oct 2025

What is Digital Banking? Key Features and Benefits for Consumers

We are living in the prime of digitalisation. From shopping to dating, every aspect of our lives has been digitalised, even banking. Digital banking has eliminated the need to visit a physical branch altogether. Today, you can open a digital savings account in minutes, transfer funds, pay bills, and even apply for loans from the comfort of your home.

14 Oct 2025

Top Reasons to Switch to Airtel Payments Bank UPI for Seamless Payments

Did you know that UPI processes over 18 billion transactions every month in India? From paying for your daily cup of coffee to recharging your phone, UPI has become the go-to payment method for most Indians. With UPI payments becoming the backbone of digital transactions, it all comes down to choosing the right UPI app.

14 Oct 2025

How to Pay Credit Card Bill from Airtel Payments Bank: Complete Guide

A new month rolls in, and with it come new bills. From utilities to credit cards, there’s one bill after another waiting to be settled. And while there might be a pile of bills to pay, there doesn’t have to be a host of apps to toggle between.

11 Nov 2025

Metro Card Explained: How to Use, NCMC Features, Smart Card Benefits

If you are a regular Metro passenger, you know just how frustrating it can be juggling multiple tickets and recharge slips while moving in and out of long queues. Not to forget rushing past the crowd, finding the way to the right platform and fighting for a seat in the metro. This is exactly where the convenience of a metro card comes in, offering you a smarter way to travel.

22 Mar 2025

4 Reasons why you need to switch to a Safe Second Account

Internet and technology has been the integral part of today’s generation. Seamless. Flexible. Quick. These are the adjectives which they associate the most with. Saving, investing and spending has become accessible on their fingertips when choosing a way to bank, convenience and quick digital interactions are their topmost priorities. India noted 48 billion digital transactions in 2020 and is set to account for 71.7% of the overall payments volume by 2025. And if you have been contemplating going digital with your money, we give you four reasons why you need to get on to this boat.

04 Feb 2025

Declutter Your Finances & Open a Safe Second Account For Daily Transactions

Managing your finances efficiently is more crucial than ever, isn’t it? As we juggle multiple financial responsibilities—our utility bills, savings, investments, and daily expenses—it's easy to feel overwhelmed. The most efficient strategy to streamline your daily expenses is to declutter your finances have a better track on your savings.

Wondering, how can be this be done? Simple, just open a separate safe second account for all your daily transactions.

18 Jan 2025

How to Order RuPay On-The-Go Card enabled with NCMC from Airtel Payments Bank?

In the ever-evolving landscape of digital era, you no long have to worry about carrying cash or buying separate tickets for different modes of transport, making travel more convenient and hassle-free. As the National Common Mobility Card (NCMC) is reshaping the way we make our daily transactions, offering unparalleled efficiency and versatility.

07 Jan 2025

Don’t Have a Safe Second Account for Your Daily Transactions? Here’s Why You Must Consider Getting One!

In today’s fast pacing digital era, gone are the days when bank accounts used to be mainly about cash deposits and withdrawals. Banks are now offering plethora of services and products all in one place. But, that can also be a little overwhelming, particularly when it comes to managing payments, as we make dozens of payments, big and small, every day. We need to add ease and convenience to our day-to-day transactions, and convenience lies in handling payments separately.

News

29 Oct 2025

Airtel Payments Bank Moves to a New Domain as per RBI Guidelines

Following the Reserve Bank of India’s (RBI) recent mandate, Airtel Payments Bank has transition to a new and more secure website domain: www.airtelpayments.bank.in. As per RBI’s directive, all banks in India are to migrate to the “.bank.in” domain in a bid to enhance cybersecurity and protect customers from online fraud.

18 Sep 2024

Airtel Payments Bank Appoints Amar Kumar as Chief Compliance Officer

Airtel Payments Bank today announced the appointment of Amar Kumar Kakarlapudi as its new Chief Compliance Officer. In this role, Amar will play a crucial part in further strengthening the Bank’s compliance framework and ensuring seamless alignment with regulatory and statutory requirements.

29 Aug 2024

Airtel Payments Bank Simplifies Digital Banking Experience with Enhanced Security and Transparency Features

Launches Fraud Alarm and Transparent Banking section for its users under the banking section of the Airtel Thanks app

28 Aug 2024

Airtel Payments Bank collaborates with Noise and NPCI to unveil its upcoming NCMC-Enabled Smartwatch

Airtel Payments Bank in collaboration with Noise, India's leading smartwatch and connected lifestyle brand, and the National Payments Corporation of India (NPCI), announced the launch of its upcoming cutting-edge NCMC (National Common Mobility Card)-enabled Smartwatch, integrated with the RuPay chip.

03 Oct 2024

NCRTC and Airtel Payments Bank Unveiled Co-Branded NCMC-Enabled Cards for a Seamless Commuting Experience

NCRTC (National Capital Region Transport Corporation) and Airtel Payments Bank have collaborated to introduce co-branded National Common Mobility Cards (NCMC) designed to enhance passenger convenience.

Events

29 Aug 2024

GFF 2024

Our Chief Operating Officer, Ganesh Ananthanarayanan at GFF 2024 in a Panel Discussion - Mobility Redefined - NCMC for an Integrated Multimodal Ticketing System

25 Sep 2024

Martech+ Summit by ET BrandEquity

Our Chief Marketing Officer, Shilpi Kapoor at Martech+ Summit by ET BrandEquity in a Panel discussion - Privacy-First Personalisation: Navigating the Emerging Data Landscape

06 Sep 2023

FIBAC 2024

Our MD and CEO, Anubrata Biswas at FIBAC 2024 in a Panel discussion - Fintech evolution: Balancing innovation & Risk management

29 Aug 2024

GFF 2024

Our MD and CEO, Anubrata Biswas at GFF 2024 in a Trialogue - Decluttering Financial Services Experience through Digital Banking.

Awards

Great Place To Work

Recognized as Great Place to Work® Institute (India)

Best Digital Integrated Marketing

For Daily Transaction Account Category Creation Campaign

ET Digiplus Awards

Silver in BFSI Campaign

Silver in Brand Awareness Campaign

For Daily Transaction Account Category Creation Campaign

Best Product/Service Innovation of the Year

The Bank earned this recognition for its fully digital SBA onboarding journey, which eliminates the need for any agent intervention, setting a new standard in seamless, customer-centric banking.

ASSOCHAM Awards on Banking & Financial Sector Lending Companies

Best Risk and Cyber Security Initiatives for class Small Finance Banks, RRBs, Co-Operative Banks & Payment Banks